About Us

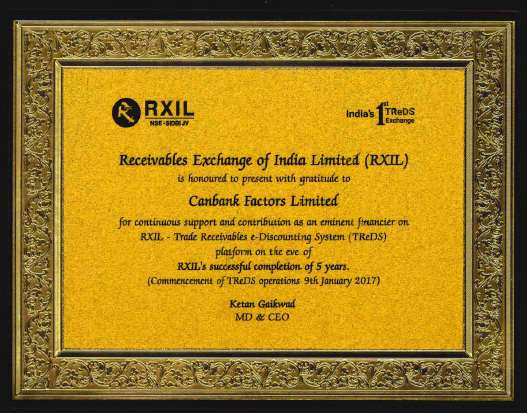

CANBANK FACTORS LTD

A subsidiary of CANARA BANK,

a leading Public Sector Bank, reputed for its diversified and professional services. Incorporated in the year 1991, with Small Industries Development Bank of India(SIDBI) and Union Bank of India as co-promoters.

The Chairperson is the Executive Director from Canara Bank and the Managing Director is an Executive in the top management cadre of Canara Bank.

Total Users : 78661

Total Users : 78661