SALE BILL FACTORING

Domestic or Sale Bill or Regular factoring means purchase of account receivable arising from supply of goods and services to domestic buyers.

In simple terms – providing finance against your domestic receivable / book debts

Regular factoring ensures cash flow to the Seller without choking the operating cycle.

Under this, limits will be fixed to Seller based on the financial strength and rating they get based on the financial and other parameters.

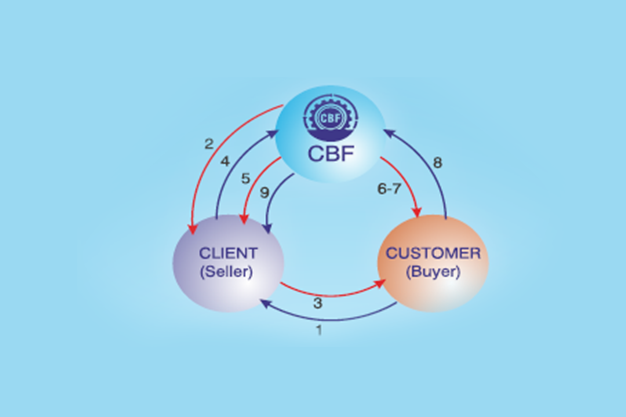

Mechanics of Sale Bill Factoring.

- Customer places order on the client.

- Factor fixes Customer limit.

- Client delivers good and invoice to customer with notice to pay Factor.

- Client tenders copy of invoice to factor.

- Finance of 80% to 90% of Invoice Value.

- Factor sends monthly statements to Customers.

- Factor to follow up and reminds if unpaid by due date.

- Customers make payment to Factor.

- Factor releases balance amount to the client.

Total Users : 78661

Total Users : 78661