About Us

WELCOME TO

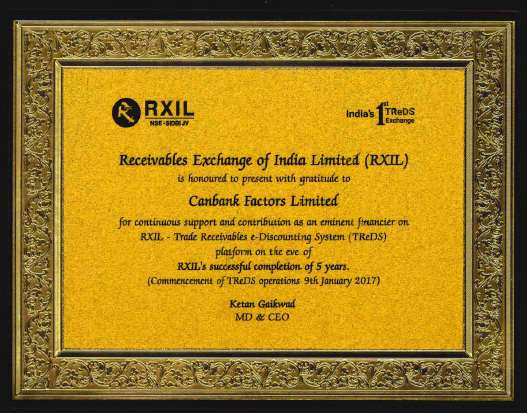

CANBANK FACTORS LTD

A subsidiary of CANARA BANK,

a leading Public Sector Bank, reputed for its diversified and professional services. Incorporated in the year 1991, with Small Industries Development Bank of India(SIDBI) and Union Bank of India as co-promoters.

A Non-Banking Financial Company

and one of the leading Factoring Company in INDIA. The Chairman & Managing Director and the Executive Director of CANARA BANK are the CHAIRMAN and the VICE CHAIRMAN respectively of the Company.

Total Users : 74336

Total Users : 74336